How the Wealthy Use Leverage to Reduce Risk

The average investor chases risk with their own money and gets upset when they lose. The wealthy use larger amounts of other people’s money in safe assets and win every time.

🦉Learn: How the Wealthy Use Leverage to Reduce Risk

The traditional way of saving - month after month, year after year - is inefficient and risky. It also won’t make you wealthy.

With this traditional method, success is based on three things. The cards are stacked against you with all three:

How Much You Can Save

So many things can derail this. Job changes. Your business doesn't sell. Higher taxes. Kids’ college. Who knows! Life happens and it's more expensive than ever.Rate of Return

Bad investment choices, poor market timing, your adviser sucks, taking too much risk and chasing a rate of return. All these things can happen.How Much Time You Have

Our parents and grandparents were able to work the same job and save for 30 or 40 years. Will you even have the same job 5 years from now? Will your company still exist? Maybe you have a long earning window, but who knows.

We are innovating with technology all the time, yet most people are still following wealth building strategies designed in the 1980’s.

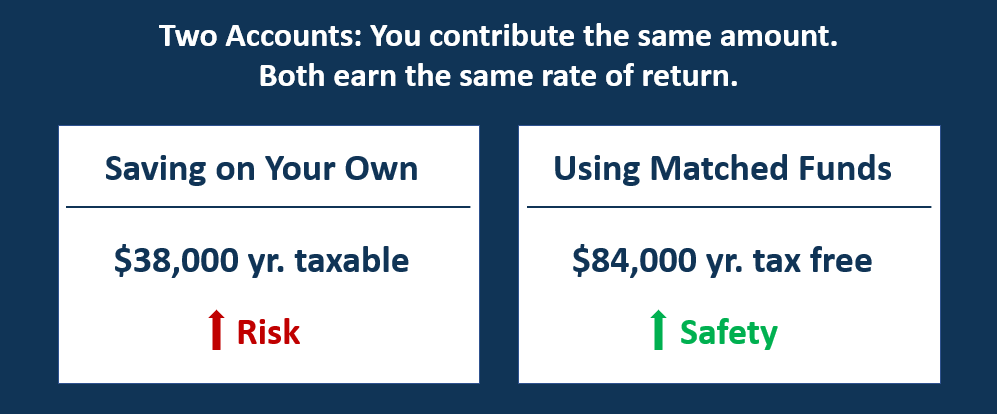

Here’s an example of innovation using safe leverage. Bank partners match your contribution with $3 for every $1 you add. Example: You add $250,000. Bank adds $750,000.

You now have $1,000,000 secured, tax free and growing for retirement.

The key to structuring this is to do so without loans, interest payments or outside collateral. The is a method of self-collateralization. The asset itself is the collateral, makes the interest payments, etc.

Now, since you have more money working for you today, you can have 2-3 times more retirement income for the future:

Most people are familiar with this concept for real estate. But there are other assets as well and you can set these up to create tax free income streams for retirement which can save you six figures or more during retirement as discussed here.

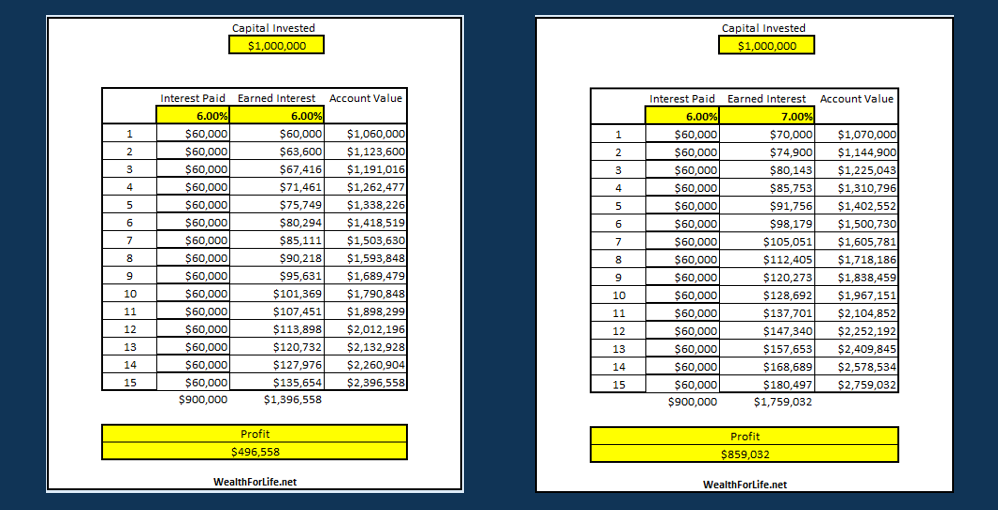

This is based on the concept of “creating arbitrage” or “earning money on the spread”. The basic principles of banking. Oddly enough, if you have time, you don’t even need a spread. This is because loans are based on simple interest while money earns compound interest:

This ability to earn money on the spread multiples the rate of return on the capital you invested. A six percent rate of return in a safe asset can become a 9% return on capital invested. Making it tax free gets you a taxable equivalent of 12%.

The idea here is you are multiplying your ROI without taking on more risk. You are actually reducing risk!

Here’s a quick video on the concept of how leverage boosts your return on capital:

If you would like to learn more about strategies like this sign up for the March 7th Event LinkedIn: The Top Three Millionaire Strategies To Cut Taxes and 5x Your Wealth

📈 Chart: The Best Opportunities of the Modern Era?

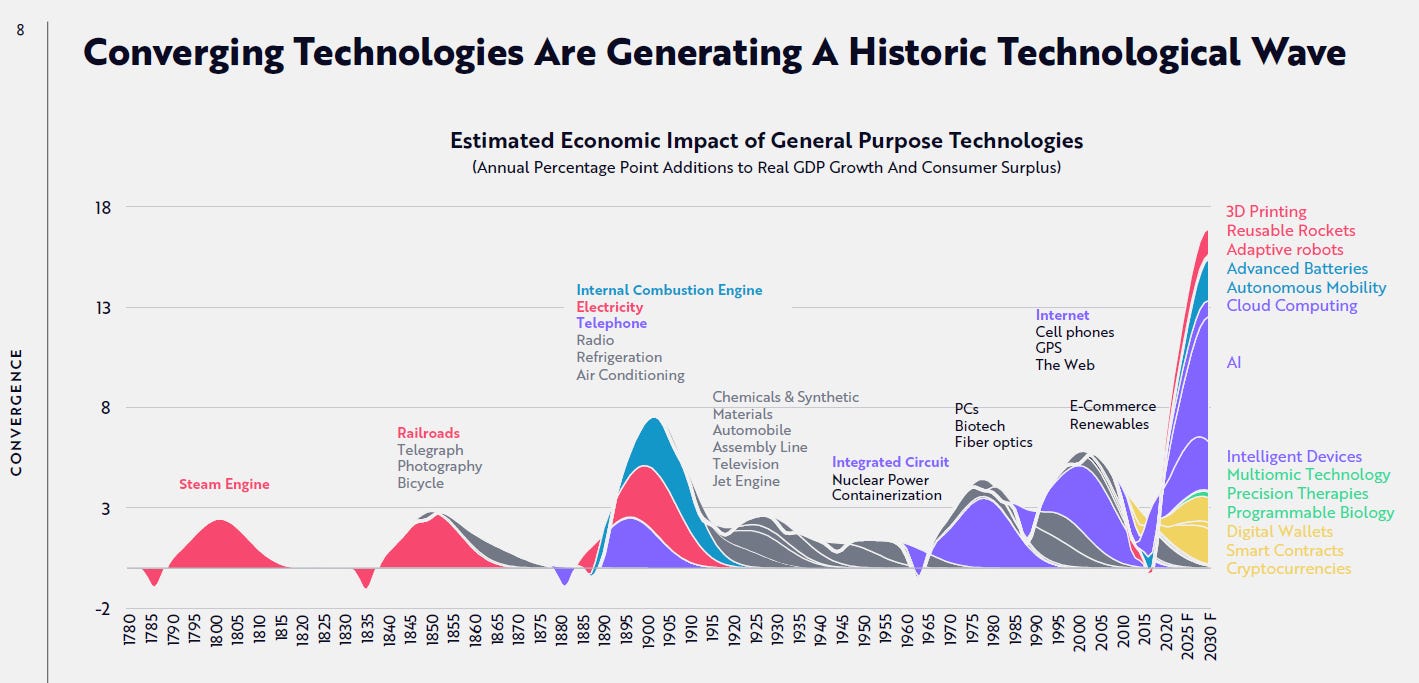

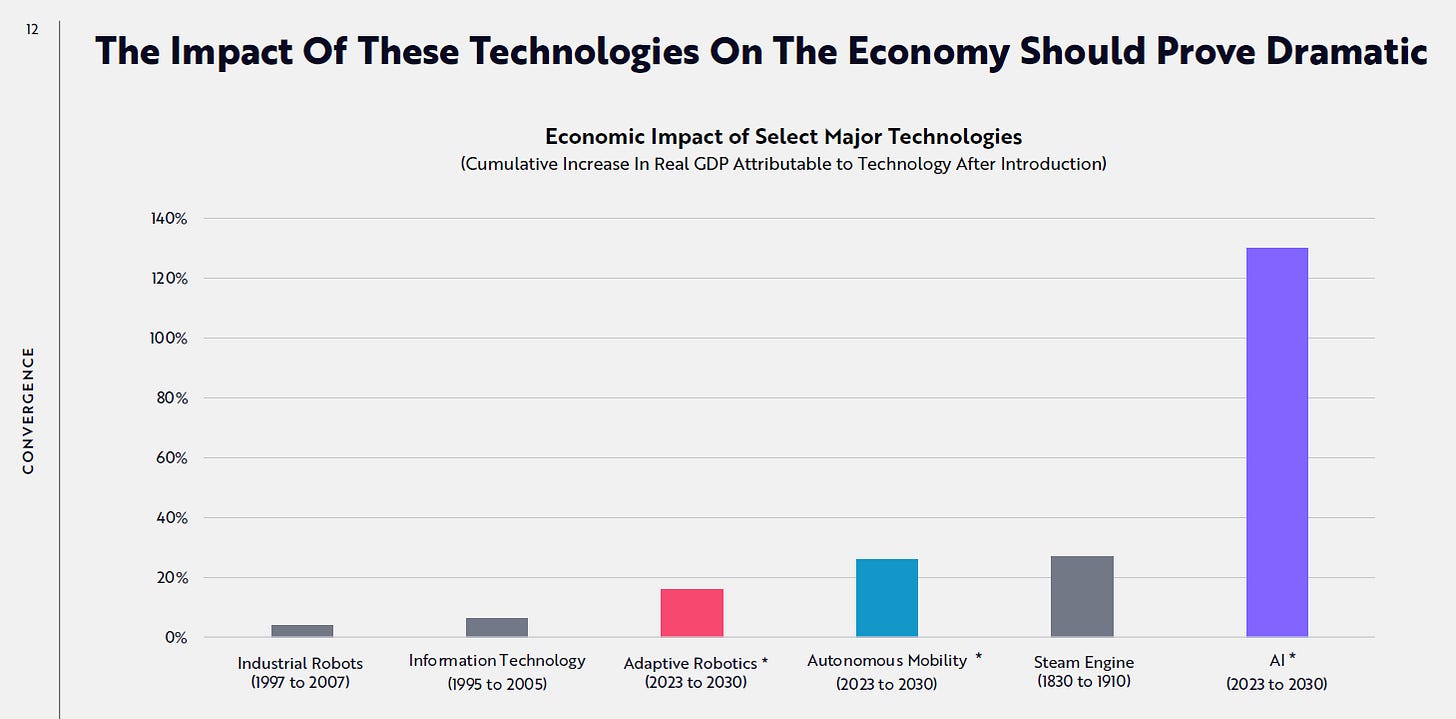

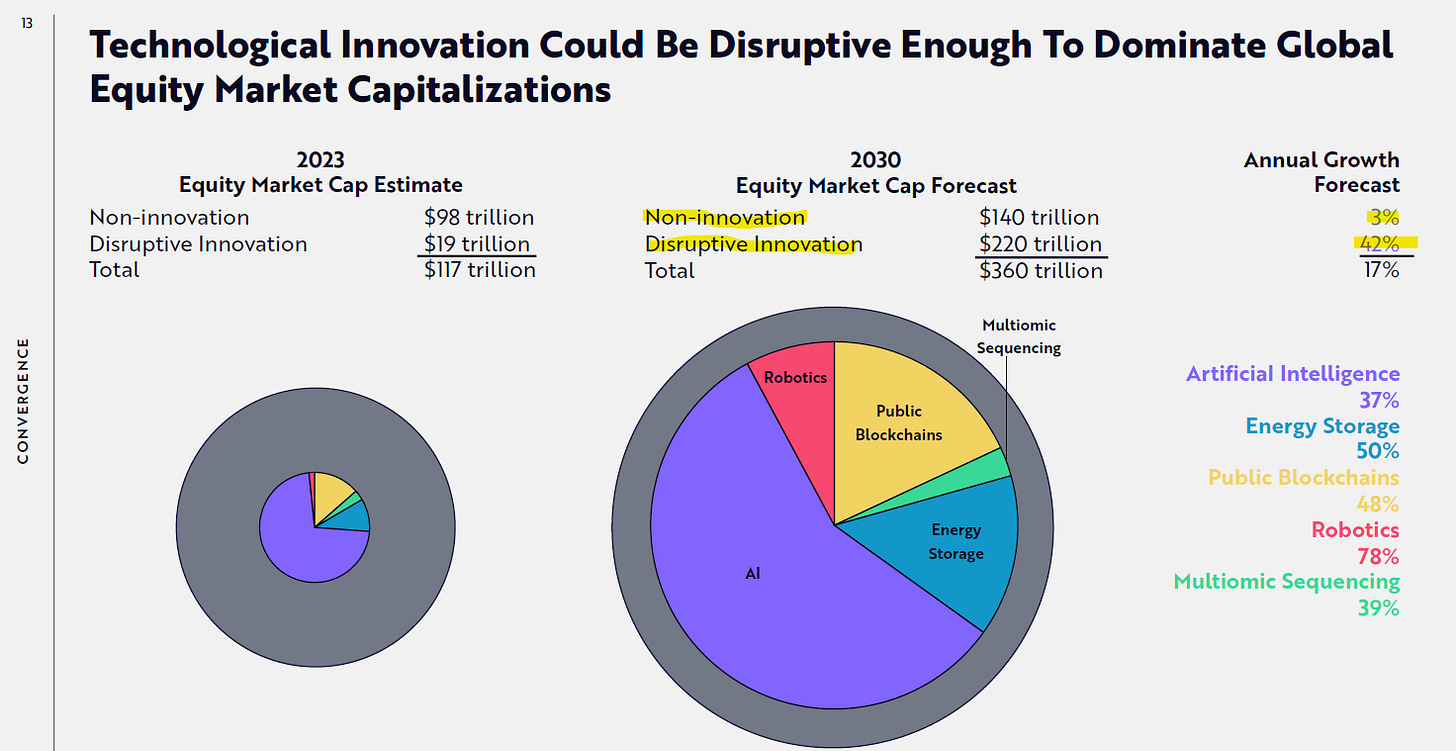

We are facing the largest convergence of technologies in history:

One takeaway here is the the impact of the steam engine was over 80 years. We are talking about the next seven years with disruptive technology.

The dominance over the next seven years could be big:

The important question when looking at these charts is are your assets positioned to take advantage of opportunities when they arrive?

That is, are you using the right mix of offensive and defensive assets so you can take risks without fear?

Fear is one of the biggest contributors to failure. The old saying “Never go to Vegas with scared money” has proven to be true over and over.

To learn more about the offense/defense framework, check out this issue of the MFD:

📘 Productivity: The Mighty Clove for the Common Cold

With 2 kids, cold season around the house is not fun. Over the past few months we’ve been getting great results with cloves.

My son typically has a pattern with a cold. Starts with the runny nose. Then gets to the ears. Then the chest.

Intro the common clove you have in your spice rack. Just pop it in your mouth and suck on for as long as you can. Eventually is will just soften up and you can spit it out or swallow it.

For my son, this has dramatically shortened the cold cycle and helped to minimize the overall symptoms and progression. (In combination with a sinus rinse.)

It’s also kept things at a minimum around the house. I have not found anything natural that provides better relief for sinus congestion. Also helps with sore throats. For sure, you need to keep using them while you are sick, but it has helped all of us.

A few facts about cloves:

Antimicrobial Properties: Cloves possess significant antimicrobial properties that can help fight against various bacteria, viruses, and fungi.

Anti-inflammatory Effects: The eugenol found in cloves has potent anti-inflammatory properties. This can help reduce inflammation in the respiratory tract, which is beneficial for relieving symptoms of a cold, such as sore throats and coughs.

Immune System Boost: Cloves are rich in antioxidants, which help strengthen the immune system to better fight off the viruses and reduce severity of symptoms.

Pain Relief: Cloves can act as a natural pain reliever soothing sore throats due to its numbing effects.

Expectorant Properties: Cloves help break up phlegm and mucus to relieve congestion and make breathing easier when suffering from a cold.

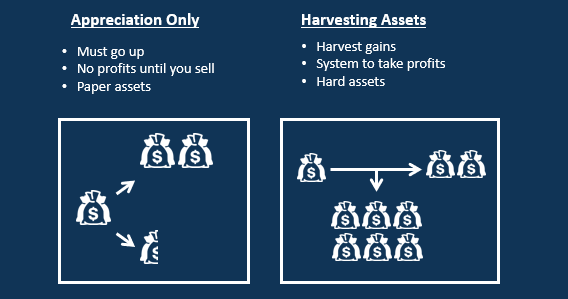

💡 Concept: Asset Strategies - Appreciation and Harvesting. Have both.

📖 Resources:

“5 Secret Strategies Millionaires Use To 5x Their Wealth & Immediately Cut Their Taxes By 50%” get instant access in the Wealth For Life LinkedIn Group — https://www.linkedin.com/groups/5156642/

Want to brainstorm on financial topics? It’s great to have conversations!

Click here to schedule a chat via zoom: https://bit.ly/3JCGpCF

Thank you for reading!